Financial Literacy & Career Readiness Workshops and Programs

"An investment in knowledge always pays the best interest"

– Benjamin Franklin

Our vision at Life Skills 911 is to create a world where every individual possesses the financial

knowledge and career skills necessary to achieve their fullest potential.

"I enjoyed the workshop! This helped me understand what challenges I'll face with money in the upcoming years and how to deal with them.”

At Life Skills 911, our mission is to empower individuals with the knowledge and skills needed to achieve financial stability and career success.

Our Financial Literacy and Career Readiness Workshops and Programs are interactive and customized per audience and age group. We come to YOUR site and provide essential and relevant workshops.

How We Work

We implement financial management and career readiness courses designed for all audiences and age groups.

School-aged children (Grades 5-12)

College students

Parents and adults in transition (e.g. individuals in prison re-entry programs and community shelters)

Elementary School (4th and 5th grade; 8-10 years old)

Middle School (6th to 8th grade; 10-13 years old)

High School (9th to 12th grade; 14-18 years old)

Parents of school aged children

They say the hardest job you’ll ever have is being a parent. Having to manage all the new expenses that go along with having children—and saving for their future needs—are certainly big reasons why that’s the case.

“It’s one thing to know the skills, but it’s also highly beneficial to start learning how to apply them into your everyday life,” said Brittany Griffin, policy and communications deputy at the Utah Office of State Treasurer. “In an ideal world, parents would start talking with their children about money very early on.”

Are essential for preparing students to navigate the complexities of the modern financial landscape.

By teaching practical skills, fostering independence and empowerment, and promoting economic equality, these courses empower students to make informed financial decisions and build brighter futures for themselves and their communities.

Parents learn how to talk about finances, learn effective communication and financial skills to share with children to shape how your children manage money in the future.

WHAT SETS LIFE SKILLS 911 APART

What truly sets Life Skills 911 Workshops apart is that we take the time to learn what every client/school partner is looking for.

- All participants receive customized age- and audience-appropriate content.

ESSENTIAL SKILLS FOR EVERYDAY LIVING

Personal finance and career readiness skills are vital in the 21st century, including budgeting strategies, understanding and managing credit, risk management, banking and investing basics, understanding financial options for career or college, as well as conducting job searches and preparing for the workforce.

OUR COMMITMENT TO THRIVING COMMUNITIES

Life Skills 911 is committed to empowering individuals and communities toward self-sufficiency in meeting their financial and career goals.

Our workshops ensure that all students, regardless of their zip code, have an equal opportunity to learn essential financial skills.

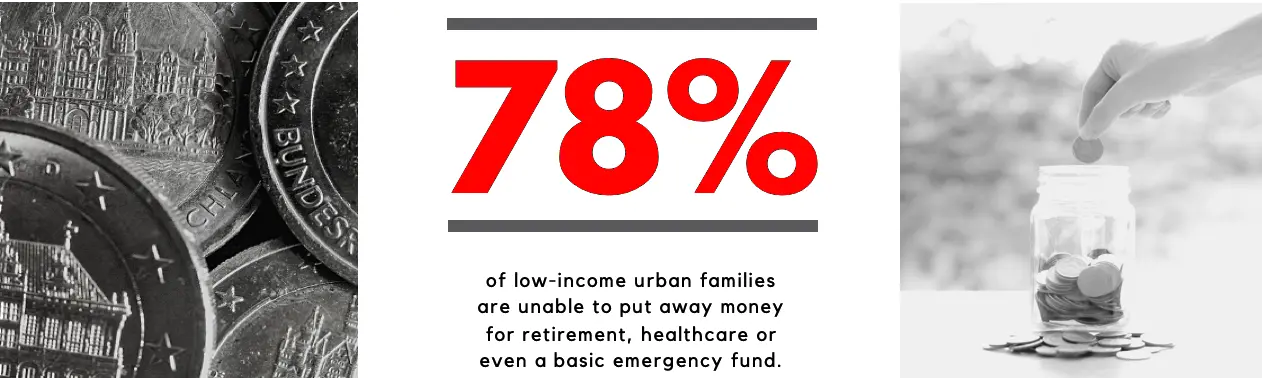

78% of low-income urban families are unable to put away money for retirement, healthcare or even a basic emergency fund.

OUR CLIENT/SCHOOL PARTNERS

Life Skills 911 partners with public/private high schools, colleges, universities, specialty schools, and community-based organizations to deliver highly interactive financial literacy and career readiness workshops to teens and adult community members.

WHY DO WE NEED FINANCIAL LITERACY AND CAREER READINESS WORKSHOPS?

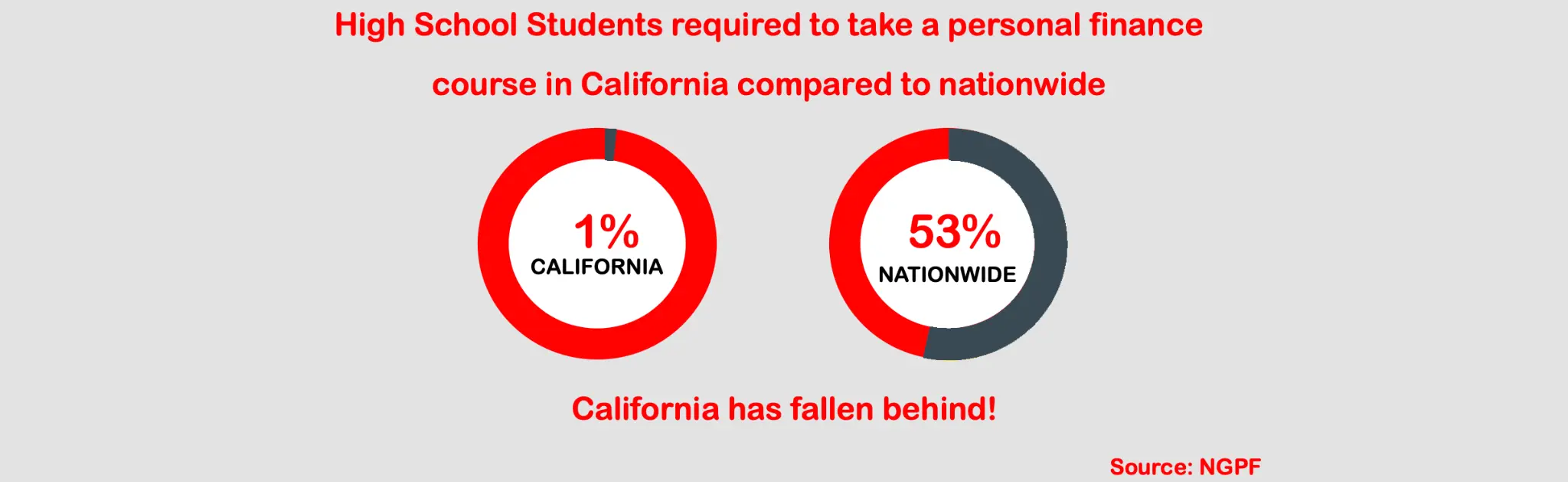

California has lagged behind the rest of the nation when it comes to personal finance education.

- Only 1% of California students are required to take a personal finance course as a condition for graduation compared to 53% nationally.

- Ensuring that students — regardless of where they go to school or their economic status — have equal opportunity to learn about personal finance is critical.

DOES PERSONAL FINANCE EDUCATION WORK?

Students who take a personal finance course have better financial outcomes, including lower credit card debt, higher credit scores, and lower delinquency rates.

A lengthy list of research studies finds that personal finance education:

- Results in fewer defaults and higher credit scores among young adults

- Reduces usage of high-cost borrowing (e.g., payday loans)

- Ensures that when it comes to paying for college, students are more likely to apply for financial aid and less likely to take out private student loans

- Ensures students are more likely to save for retirement after learning about the power of compounding

- (Source: NGPF Research and Policy Papers)