The Need for Financial Literacy & Career Readiness

"I enjoyed the workshop! This helped me understand what challenges I'll face with money in the upcoming years and how to deal with them.”

At Life Skills 911, our mission is to empower individuals with the knowledge and skills needed to achieve financial stability and career success.

We are dedicated to providing comprehensive, accessible, and engaging workshops that promote financial literacy and career readiness for people of all ages and backgrounds.

By equipping our participants with practical tools, informed strategies, and actionable insights, we aim to foster a community of confident and capable individuals who can navigate their financial futures and professional paths with clarity and purpose regardless of their socio-economic condition.

Our commitment is to inspire informed decision-making, encourage proactive career planning, and ultimately, to contribute to the economic well-being and prosperity of the communities we serve.

Our vision at Life Skills 911 is to create a world where every individual possesses the financial knowledge and career skills necessary to achieve their fullest potential.

We strive to be a leading catalyst in transforming lives by making financial literacy and career readiness education universally accessible and deeply impactful.

Through our innovative and comprehensive workshops, we envision a future where individuals from all walks of life are empowered to make informed financial decisions, pursue fulfilling careers, and build a secure and prosperous future.

Our ultimate goal is to contribute to the creation of a financially literate and career-ready society, fostering economic resilience, personal growth, and community well-being.

1. Empowerment: We believe in empowering individuals with the knowledge and skills needed to take control of their financial futures and career paths. Our workshops are designed to build confidence and foster self-reliance.

2. Accessibility: We are committed to making financial literacy and career readiness education accessible to everyone, regardless of their background or current financial situation. Our resources are designed to be inclusive and adaptable to diverse needs.

3. Integrity: We operate with the highest level of integrity, providing accurate, unbiased, and transparent information. We are dedicated to earning and maintaining the trust of our participants.

4. Innovation: We strive to continually innovate and improve our workshops to ensure they remain relevant, engaging, and effective. We embrace new technologies and methodologies to enhance the learning experience.

5. Community: We value the power of community and collaboration. We aim to create a supportive learning environment where participants can share experiences, learn from each other, and build lasting networks.

6. Lifelong Learning: We advocate for continuous personal and professional development. Our workshops encourage a mindset of lifelong learning, equipping individuals with the tools to adapt and thrive in an ever-changing world.

7. Practicality: We focus on providing practical, actionable insights that can be immediately applied to real-life situations. Our goal is to offer education that directly impacts participants’ financial well-being and career success.

8. Respect: We treat all participants with respect and dignity, valuing their unique perspectives and experiences. We are committed to creating an inclusive environment where everyone feels valued and heard.

9. Excellence: We are dedicated to delivering the highest quality of education and service. We continuously seek to improve and excel in all aspects of our work to best serve our participants.

10. Accountability: We hold ourselves accountable for the outcomes of our programs and the success of our participants. We measure our impact and use feedback to drive our commitment to excellence and continuous improvement.

WE OFFER KNOWLEDGE & SKILLS

Essential Skills for Everyday Living

Personal finance and career readiness skills are vital in the 21st century, including managing credit, understanding financial options for career or college, and budgeting for everyday living.

Equal Opportunity

Gaining Financial Literacy and Career Readiness Skills ensures that all students, regardless of their zip code, have an equal opportunity to learn essential financial and career readiness skills. They are well prepared for their future goals of college and/or career.

Impact on Financial Future

Students who take a personal finance course have better financial outcomes, including lower credit card debt, higher credit scores, and lower delinquency rates.

Does Personal Finance Education Work?

A lengthy list of research studies finds that personal finance education:

Results in fewer defaults and higher credit scores among young adults

Reduces usage of high-cost borrowing (e.g., payday loans)

Ensures that when it comes to paying for college, students are more likely to apply for financial aid and less likely to take out private student loans

Ensures students are more likely to save for retirement after learning about the power of compounding

KEY TAKEAWAYS

Teaching financial literacy at a younger age helps children develop healthy, lifelong financial habits.

The main principles of financial literacy include earning, saving, investing, protecting, spending, and borrowing.

Specific government policies and societal discrimination have fed into the creation of a racial wealth gap, which is important to note when it comes to financial literacy.

Financial literacy can encourage habits that can help children avoid debt traps later in life.

Children can form money habits starting as young as age 5.

What Are the 5 Principles of Financial Literacy?

The five principles of financial literacy are:

Earn • Save and Invest • Protect • Spend • Borrow

Focus on understanding your pay and benefits, then develop a budget to save and invest your earnings.

Ensure your financial health is protected by, for example, having an emergency savings.

Finally, be sure that you are spending wisely and that you borrow responsibly.

WHAT IS THE FIRST RULE OF FINANCIAL LITERACY?

The first rule of financial literacy is to understand your pay, or your earnings.

Understanding your pay includes knowing what benefits are available to you and how you can take advantage of them.

5 Rules to Improve Your Financial Health

The term “personal finance” refers to how you manage your money and plan for your future. All of your financial decisions and activities have an effect on your financial health. It’s always important to consider what we should be doing—in general—to help improve our financial health and habits.

“Personal finance” is too often an intimidating term that causes people to avoid planning, which can lead to bad decisions and poor outcomes.

Take the time to budget your income vs. expenses, so you can spend within your means and manage lifestyle expectations.

Successful financial planning entails being mindful of spending regardless of your income level or of what you want but don’t need.

By saving early, you capture more potential of compounding – investment growth on prior investment growth.

Always prioritize creating an emergency fund; you never know when something will come up.

7 Everyday Activities That Teach Kids About Money

Research suggests that many of our financial habits are set by age seven. If good habits aren’t formed early, it becomes harder to point your offspring in the right direction. Here are seven activities to help guide them.

- Make Them Earn Their Allowance

- Encourage Part-Time Gigs

- Contribute to Purchases

- Make It a Game

- Open a Bank Account

- Introduce Investing

- Have Honest Conversations About Money

Having kids earn their allowance through household chores can help them build the self-reliance they’ll need later in life.

Opening a savings account or kid-friendly debit card teaches the value of saving and provides an introduction to the banking system.

Allowing your kids to observe budgeting discussions can help them learn how to spend responsibly.

Teaching Financial Literacy FAQ

Why Should Learning Financial Literacy in High School Be a Priority?

- Less than a third of high school juniors and seniors reported that they felt prepared to compare financial institutions and select one that best meets their needs (32%). Slightly more students — but still less than half (47%) — felt they could select, open, and manage a savings or checking account.

Young people also reported low levels of confidence in their ability to establish financial habits that contribute to long-term financial wellbeing: budgeting and managing credit. Half of juniors and seniors said they were “prepared” or “very prepared” to set up and follow a budget, while just a third (32%) felt they could check their credit and maintain good credit over time.

These skills budgeting and managing credit – are essential as young people move toward financial independence. The decisions they make in the next one to two years begin to carry consequences that can last much longer, directly impacting their lifetime financial wellbeing.

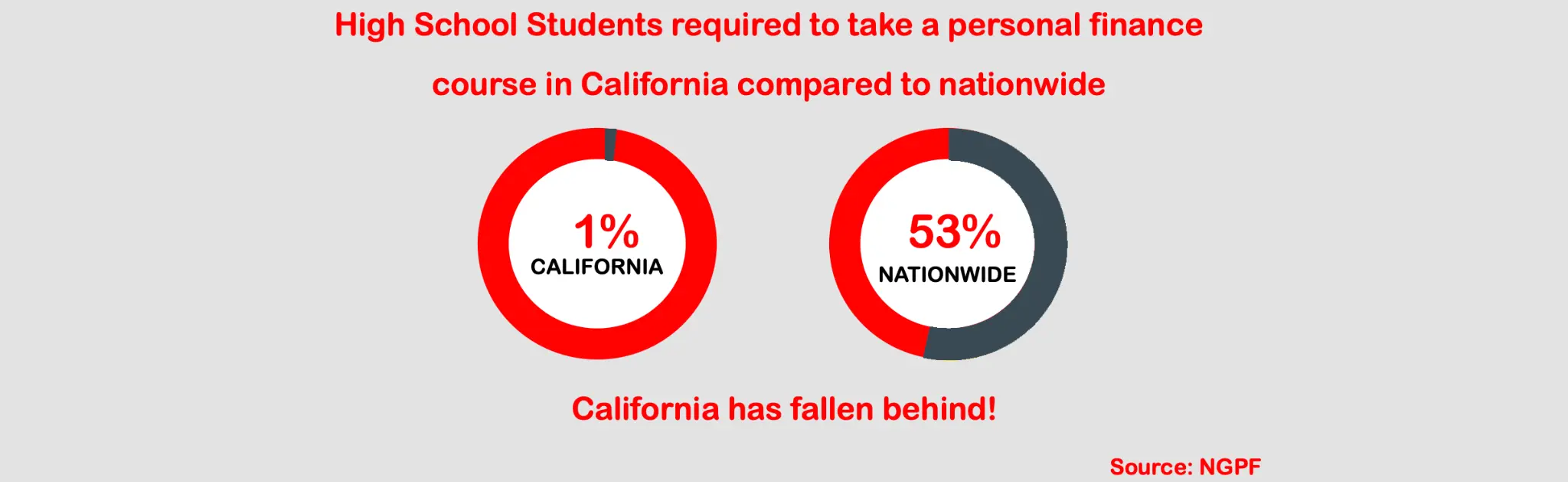

Only 1% of California students are required to take a personal finance course as a condition for graduation compared to 48% nationally. Ensuring that students — regardless of where they go to school or their economic status — have equal opportunity to learn about personal finance is critical.

Why Should Learning Financial Literacy in High School Be a Priority?

Yes, given the critical role of skill and confidence in building financial wellbeing, the low levels of preparedness among young people could be a sign of trouble as students finish high school and move toward financial independence.

of Americans failed to Pass the S&P Global FinLit Survey on basic financial concepts

have investments other than a basic savings account

would need to borrow funds or take out a loan in the event of an health emergency

What Is The Benefit From Learning Financial Literacy?

Students learn the fundamentals of money management in financial literacy classes, including budgeting, saving, paying off debt, investing, and more. This information offers the groundwork for kids to establish sound financial practices at a young age and steer clear of many mistakes that result in ongoing financial difficulties.

The Bottom Line

Teaching financial literacy is important to instilling healthy habits in children so they can make the best decisions about money throughout their lives.

Start financial lessons at an early age to give them a head start in developing these critical skills, then continue to provide financial guidance on more advanced lessons as they are ready. The strategies you use to foster financial literacy in your child will depend on how your child learns and how you best interact together.